The Best Strategy To Use For Custom Private Equity Asset Managers

Wiki Article

The 7-Minute Rule for Custom Private Equity Asset Managers

(PE): spending in firms that are not openly traded. About $11 (https://www.gaiaonline.com/profiles/cpequityamtx/46495878/). There may be a few things you don't recognize concerning the market.

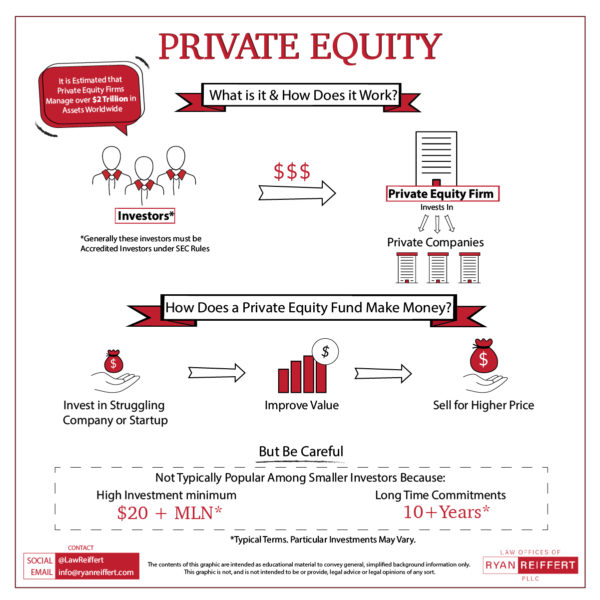

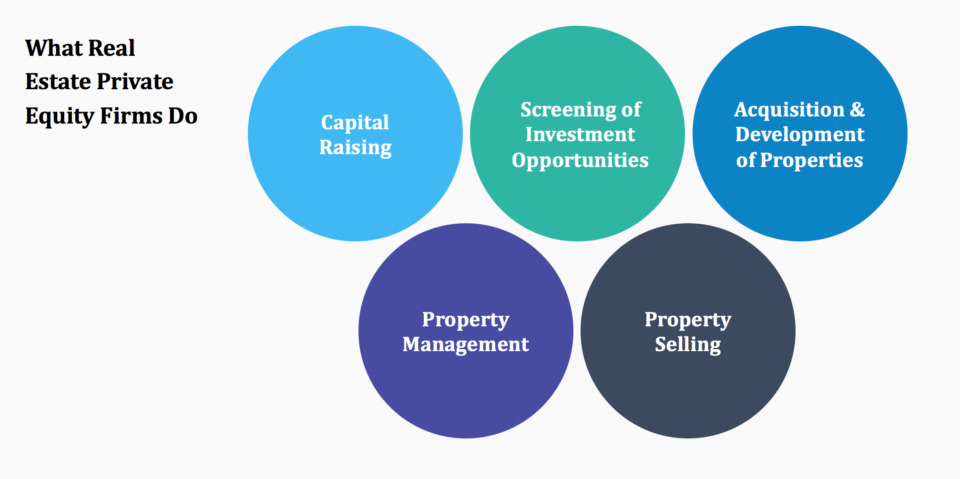

Companions at PE firms raise funds and take care of the money to produce desirable returns for investors, typically with an financial investment perspective of in between 4 and seven years. Private equity firms have a series of investment preferences. Some are stringent investors or easy financiers completely based on administration to grow the firm and produce returns.

Due to the fact that the finest gravitate toward the bigger offers, the middle market is a dramatically underserved market. There are extra sellers than there are very experienced and well-positioned financing specialists with considerable purchaser networks and resources to take care of a deal. The returns of exclusive equity are typically seen after a few years.

Not known Facts About Custom Private Equity Asset Managers

Flying listed below the radar of big international companies, many of these little companies commonly give higher-quality client service and/or specific niche product or services that are not being used by the huge corporations (https://filesharingtalk.com/members/589221-cpequityamtx). Such benefits draw in the rate of interest of personal equity companies, as they have the understandings and wise to make use of such opportunities and take the firm to the next degree

Exclusive equity investors must Get More Information have trustworthy, qualified, and reliable management in area. A lot of managers at profile firms are provided equity and incentive compensation structures that compensate them for hitting their monetary targets. Such alignment of goals is normally needed before a deal obtains done. Personal equity opportunities are typically out of reach for individuals who can't invest millions of bucks, yet they should not be.

There are guidelines, such as restrictions on the aggregate quantity of money and on the variety of non-accredited investors. The private equity organization draws in a few of the most effective and brightest in business America, including leading performers from Ton of money 500 firms and elite administration consulting firms. Law practice can likewise be recruiting premises for exclusive equity works with, as bookkeeping and lawful abilities are essential to complete offers, and deals are extremely searched for. https://custom-private-equity-asset-managers.mailchimpsites.com/.

Custom Private Equity Asset Managers - An Overview

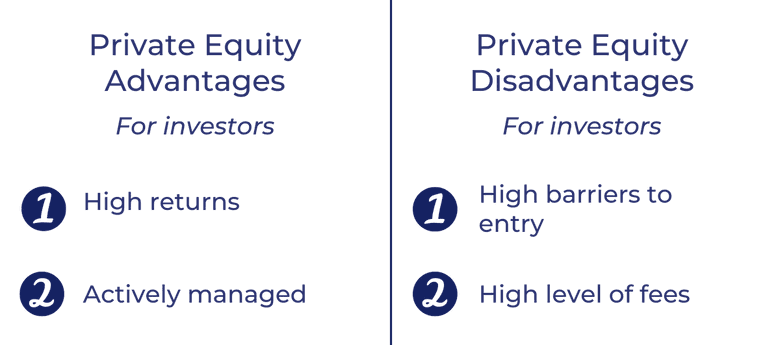

One more negative aspect is the lack of liquidity; when in an exclusive equity transaction, it is challenging to leave or sell. There is an absence of adaptability. Exclusive equity also comes with high fees. With funds under monitoring already in the trillions, exclusive equity firms have come to be eye-catching investment lorries for well-off people and institutions.

For decades, the attributes of personal equity have actually made the possession course an appealing suggestion for those that might participate. Now that access to private equity is opening up to even more specific investors, the untapped possibility is ending up being a reality. So the inquiry to think about is: why should you invest? We'll begin with the primary arguments for purchasing personal equity: How and why personal equity returns have historically been more than other properties on a variety of degrees, Just how consisting of private equity in a portfolio influences the risk-return profile, by assisting to expand against market and intermittent risk, After that, we will certainly detail some vital considerations and dangers for exclusive equity financiers.

When it involves presenting a brand-new possession into a portfolio, the most basic factor to consider is the risk-return account of that possession. Historically, exclusive equity has shown returns comparable to that of Arising Market Equities and more than all various other typical possession courses. Its fairly reduced volatility combined with its high returns produces an engaging risk-return profile.

What Does Custom Private Equity Asset Managers Mean?

Actually, private equity fund quartiles have the largest range of returns across all alternative property classes - as you can see below. Technique: Interior price of return (IRR) spreads computed for funds within vintage years individually and afterwards averaged out. Mean IRR was computed bytaking the average of the mean IRR for funds within each vintage year.

The takeaway is that fund option is crucial. At Moonfare, we execute a strict choice and due persistance process for all funds detailed on the platform. The impact of including private equity right into a profile is - as constantly - based on the profile itself. A Pantheon research from 2015 recommended that including exclusive equity in a portfolio of pure public equity can open 3.

On the various other hand, the finest exclusive equity companies have accessibility to an even bigger swimming pool of unidentified opportunities that do not deal with the same analysis, along with the sources to perform due persistance on them and determine which deserve buying (Asset Management Group in Texas). Investing at the very beginning suggests greater danger, however for the firms that do be successful, the fund advantages from higher returns

Custom Private Equity Asset Managers for Dummies

Both public and personal equity fund managers dedicate to investing a percent of the fund yet there continues to be a well-trodden problem with lining up rate of interests for public equity fund management: the 'principal-agent issue'. When an investor (the 'primary') hires a public fund manager to take control of their capital (as an 'agent') they hand over control to the supervisor while retaining possession of the assets.

In the instance of exclusive equity, the General Partner does not simply earn a monitoring fee. Personal equity funds likewise mitigate one more kind of principal-agent problem.

A public equity investor inevitably desires one point - for the management to increase the supply price and/or pay out returns. The investor has little to no control over the decision. We revealed above how lots of private equity strategies - particularly majority buyouts - take control of the running of the firm, making sure that the long-term worth of the company precedes, rising the return on financial investment over the life of the fund.

Report this wiki page